virginia electric vehicle tax credit 2022

Check out these National Drive Electric Week Events in Virginia. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle.

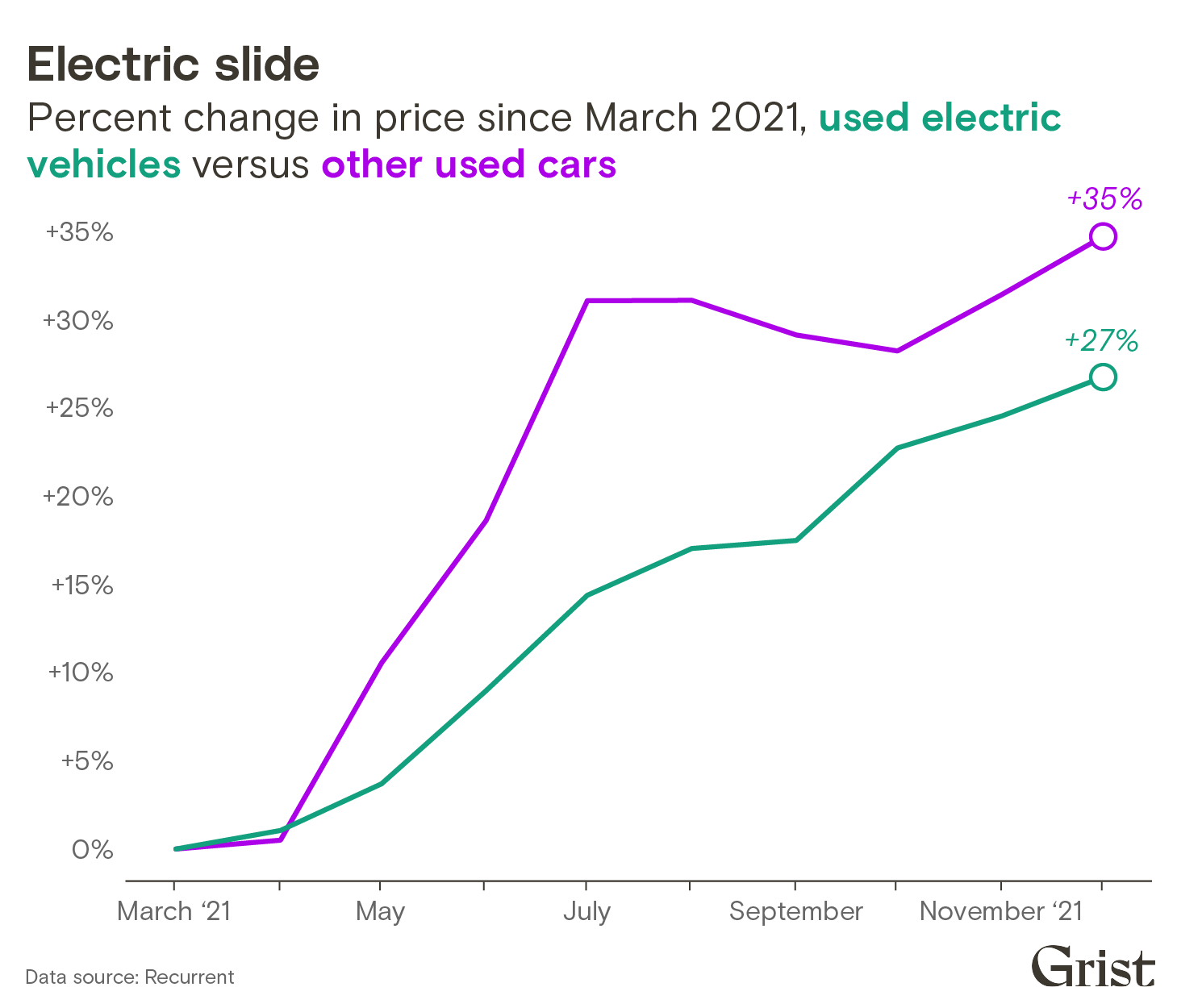

High Gas Prices Have A Lot More People Searching For Electric Vehicles Grist

Either fax your application to 804 367-6379 or mail it to.

. An EV with at least a 5 kWh battery capacity can snag you another 417 plus another 417 for each kWh above that 5 kWh threshold. Virginia electric vehicle tax credit 2022. Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price.

Electric vehicles are eligible for up to a 7500 tax credit with a few caveats. This incentive covers 30 of the cost with a maximum credit of up to 1000. The credit is also transferrable.

To learn more about the Land Preservation Tax Credit see our Land Preservation Tax Credit page. The credit is allowed for the first five years that the job is continuously filled. This incentive covers 30 of the cost with a maximum credit of up to 1000.

A qualified resident of the Commonwealth who purchases such vehicle shall also be eligible for an additional 2000 enhanced rebate. You must be the original owner. Check that your vehicle made the list of qualifying clean fuel vehicles.

Reference Virginia Code581-2217 and 581-2249 Electric Vehicle EV Rebate Program Working Group. You may be able to get a maximum of 7500 back on your tax return. The proposal to provide a 4500 incentive exclusively for union-built electric vehicles runs.

The qualified plug-in electric drive motor vehicle credit is a nonrefundable federal tax credit of up to 7500 according to Jackie Perlman. DMV Registration Work Center PO. The EV tax credits that are being proposed for 2022 are larger and more robust than previous and current electric vehicle tax credits.

The state of Virginia is not the only sector willing to reward customers for the purchase of an EV as well as a Plug-In Hybrid PEV. Beginning January 1 2022 any Virginia resident who purchases a used electric or hybrid vehicle for 25000 or less is eligible for a rebate of 2500. An income tax credit equal to 1ȼ per gallon of fuel produced.

Market then phase-out occurs. It must be purchased in or after 2010. Electric Vehicle EV Fee EV owners must pay an annual highway fee of 109 in addition to standard vehicle registration fees.

For electric cars it is a flat 8820 fee. The incentives go up as high as 12500 on new cars and up to 4000 on used electric vehicles. Box 26668 Richmond VA 23261.

Beginning July 1 2022 EV drivers may choose to enroll in a mileage-based fee program in lieu of highway use fee. Beginning January 1 2022 a resident of the Commonwealth who purchases a new electric motor vehicle from a participating dealer shall be eligible for a rebate of 2500. Unlike the existing electric vehicle tax credit which requires ev buyers to claim it on their taxes at the end of the year and can only be fully used if your tax.

2020 to December 31 2022. In addition to credits Virginia offers a number of deductions and subtractions from income that may help reduce your tax liability. Electric vehicles that get 200 or more miles of range would qualify for a 2000 rebate for new and 1000 for a used vehicle.

Download and complete the License Plate Application VSA 10 including the vehicle identification number VIN and title number. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations. Cap is 6 million per year.

Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate. If you take home a new PEV that meets certain requirements such as battery capacity overall vehicle weight and emission standards you can also receive a federal tax credit of up to 2500. As of February 2022 residents in any state can get an income tax credit to help defray the cost of both EV chargers and EV charger installations.

Find state and local-specific incentives available in your area. Check that your vehicle made the list of qualifying clean fuel vehicles. Hybrids and electric vehicles may not be a tax write off but may instead be eligible for a credit on your return.

Rebates can be claimed at or after purchase while tax credits are claimed when filing income taxes. Friday May 13 2022. The minimum federal PEV tax credit is 2500 but could be as much as 7500 depending in the PEVs battery capacity weight and one other key factor well discuss in a minute.

1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. 1 2022 would offer buyers a 2500 rebate for the purchase of a new or used electric vehicle. The PTC provides a corporate tax credit of 12 centskWh for electricity generated from landfill gas LFG open-loop biomass municipal solid waste resources qualified hydroelectric and marine and hydrokinetic 150 kW or larger sources.

Electricity from wind closed-loop biomass and geothermal resources receive as much as 23 centskWh. Qualified employers are eligible for a 500 tax credit for each new green job created that offers a salary of at least 50000 for up to 350 jobs per employer. The federal tax credit falls to 22 at the end of 2022.

The legislation will be introduced when the Virginia General Assembly convenes on January 13 2021. Tesla to get access to 7000 tax credit on 400000 more electric cars in the US with new incentive reform. January 1 2020 to December 31 2022.

Virginia Tax Credits Review the credits below to see what you may be able to deduct from the tax you owe. And potentially even more importantly these tax credits will be refundable. To get the full credit the vehicle must be within the first 200000 of that automakers electric vehicles produced in the US.

Reference Virginia Code 462-770 through 462-773 Electric Vehicle EV Parking Space Regulation. The credit amount will vary based on the capacity of the battery used to power the vehicle.

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Report Build Back Better Bill Could Stall In Senate For Months Delaying Expanded Ev Tax Credit

Rebates And Tax Credits For Electric Vehicle Charging Stations

.jpg)

Latest On Tesla Ev Tax Credit March 2022

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Hybrid Car Tax Credits 2022 Simple Guide Find The Best Car Price

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Electric Vehicles Should Be A Win For American Workers Center For American Progress

5 Mistakes To Avoid When Buying An Electric Car Autotrader

High Gas Prices Have A Lot More People Searching For Electric Vehicles Grist

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Electric Vehicle Tax Credits What To Know In 2022 Bankrate

The 12 500 Ev Tax Credit 2022 Everything You Need To Know Updated Yaa

Joe Manchin Says Ludicrous Electric Vehicle Tax Credit Not Needed Bloomberg

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Vehicle Stocks Tumble After Manchin Rejects Biden S Climate And Social Plan